GAP Enrollment

GAP Forms

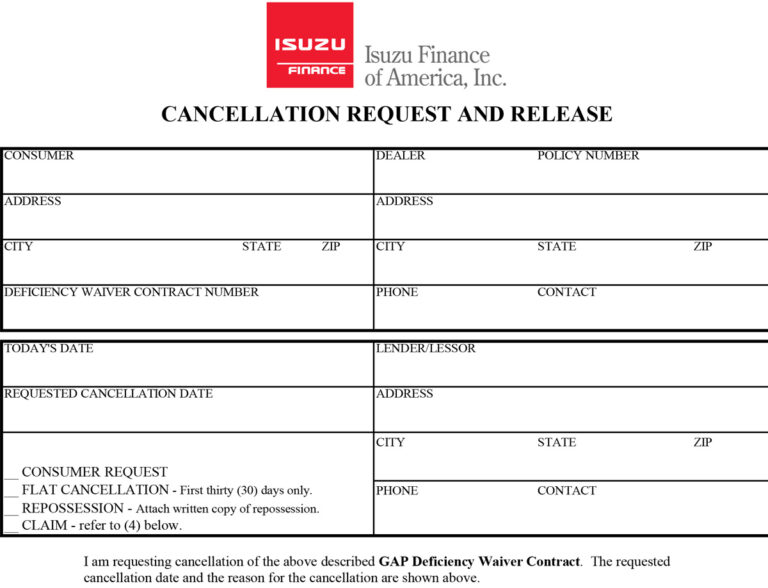

Your customer’s GAP waiver addendum may be cancelled at any time. If it is cancelled within the first thirty days from the effective date of the policy, and no loss has occurred, they will be given a full refund. For all cancellations after thirty days, the refund will be calculated by the pro rata method, unless otherwise dictated by state or lender requirements.

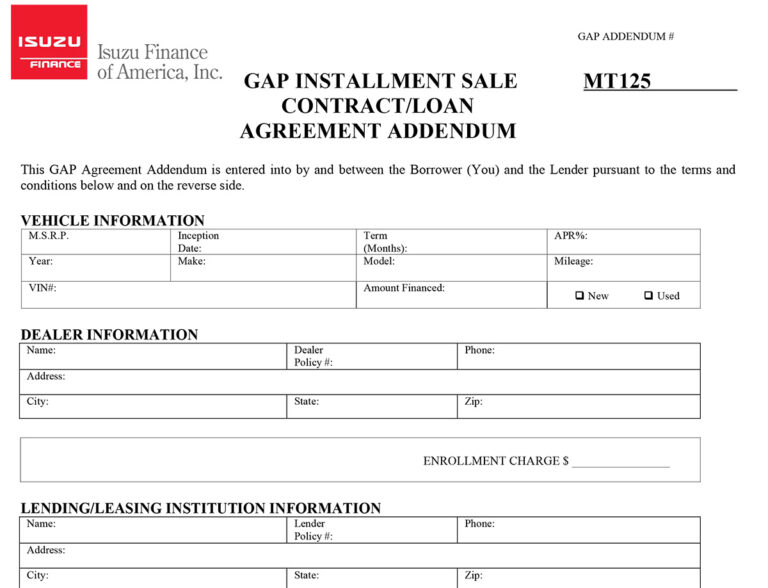

Effective June 1st, these new GAP forms should be used.

The new Isuzu GAP Waivers now include expanded information on Definitions, Conditions, Cancellation Addendum, Termination Addendum, and Exclusions, and updated state Provisions. Please note: No GAP coverage in California, New York, or Texas.

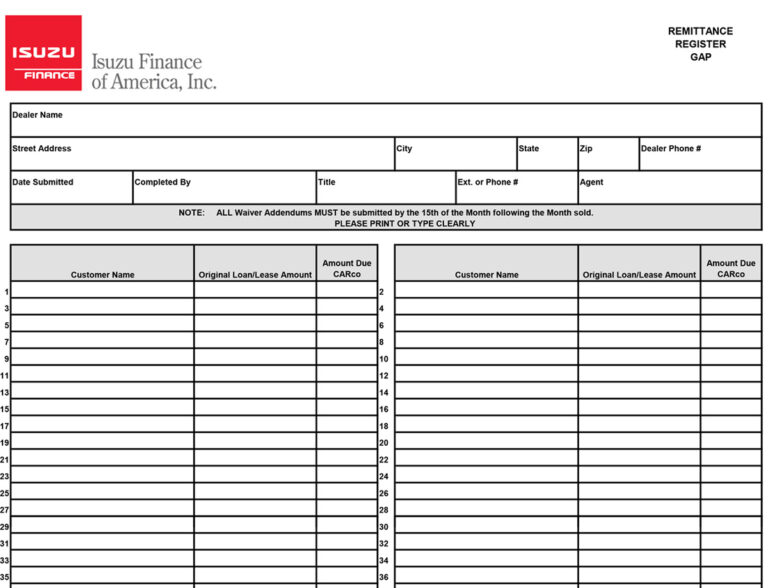

Send GAP Remittance to Carco (Non-Isuzu ONLY)

For more details on 2025 Isuzu GAP changes

Expanded definition of a “Constructive Total Loss”:

Constructive Total Loss means a direct and accidental loss of, or damage to, the Collateral, which meets one of the following criteria: 1) the Collateral is declared a total loss by the Primary Carrier or 2) no Primary Carrier coverage is in force, and either: a) the Collateral is stolen and not recovered within thirty (30) days of the Date of Loss, and remains unrecovered at the time of notification of loss (Unrecovered Theft) or b) the total cost to repair the Collateral as a result of the loss or damage is greater than or equal to its Actual Cash Value, as of the Date of Loss.

Expanded definition of “Cancellation”:

Specifically:

A Constructive Total Loss must be reported to the Administrator within ninety (90) days from the Settlement Date. No amount will be waived for any Constructive Total Loss reported after ninety (90) days. In the event there is no Primary Carrier, the Customer/Borrower has ninety (90) days from the Date of Loss to report a Constructive Total Loss. Once a Qualifying Loss has been waived, this Addendum will terminate and be considered fully earned and not subject to any cancellation refund.

In the event of a Constructive Total Loss, You must notify and provide the following to the Administrator: 1) a copy of the Financing Contract and a copy of this signed Addendum; 2) a copy of the Financing Contract history and pay-off as of the Date of Loss; 3) a legible copy of the Police Report, which must include confirmation of the Collateral shown on this Addendum. If a Police Report is not available, and the cause of loss to Collateral was not due to theft, fire, or vandalism, a signed and notarized brief description of the loss (including confirmation of the Collateral) will be acceptable; 4) a copy of the settlement check, Collateral valuation report, total loss breakdown, and Declarations Page, issued by the Primary Carrier (provided Primary Carrier coverage is in effect on the Date of Loss); 5) a copy of the Bill of Sale (aka Buyer’s Order, Purchase Agreement, etc.) as well as the manufacturer’s invoice or window sticker (if the Collateral was purchased new), or the bookout sheet (if the Collateral was purchased used); 6) verification of any other refundable amounts; and 7) any additional or reasonable documentation requested by the Administrator. The Administrator will not be able to obtain this information for You.

CANCELLATION

You have the unconditional right to cancel this optional Addendum for a refund/credit of the unearned portion of the charge for this Addendum at any time. If the Addendum is terminated, or cancelled by You, during the Free Look Period, You will receive a full refund/credit of the Addendum cost, provided no Qualifying Loss amount has been waived. After the Free Look Period, and provided no Qualifying Loss amount has been waived, You will receive a refund/credit of the Addendum cost calculated by the Pro Rata refund method, based on the number of days remaining in the Addendum term, less a $50.00 cancellation fee, where such cancellation fee is permitted by law.

In order to receive any refund due in the event of Your cancellation of this GAP Addendum, or early termination of the Financing Contract, You, in accordance with the terms of this Addendum, must provide a written request to cancel to the Dealer/Lender or Administrator within ninety (90) days of Your decision to cancel the Addendum, or the occurrence of the event terminating the Financing Contract. If the refund/credit is not received within sixty (60) days of notice of cancellation, contact the Administrator shown below.

In the event of a cancellation, the Lender will be named as payee on all refunds and sole payee on a repossession refund. Any refund due may be applied by the Lender as a reduction of the amount owed under the Financing Contract, unless You can show that the Financing Contract has been paid in full.

TERMINATION OF ADDENDUM

This Addendum will terminate on the earliest date that one of the following events occurs: 1) the date Your Addendum is cancelled; 2) the date Your Financing Contract is scheduled to terminate; 3) upon payment in full of the Financing Contract; 4) expiration of any redemption and reinstatement period following the repossession or surrender of the Collateral; 5) in the event of a Constructive Total Loss, after the Qualifying Loss has been waived or it is determined that no Qualifying Loss exists; or 6) the date the Financing Contract is refinanced